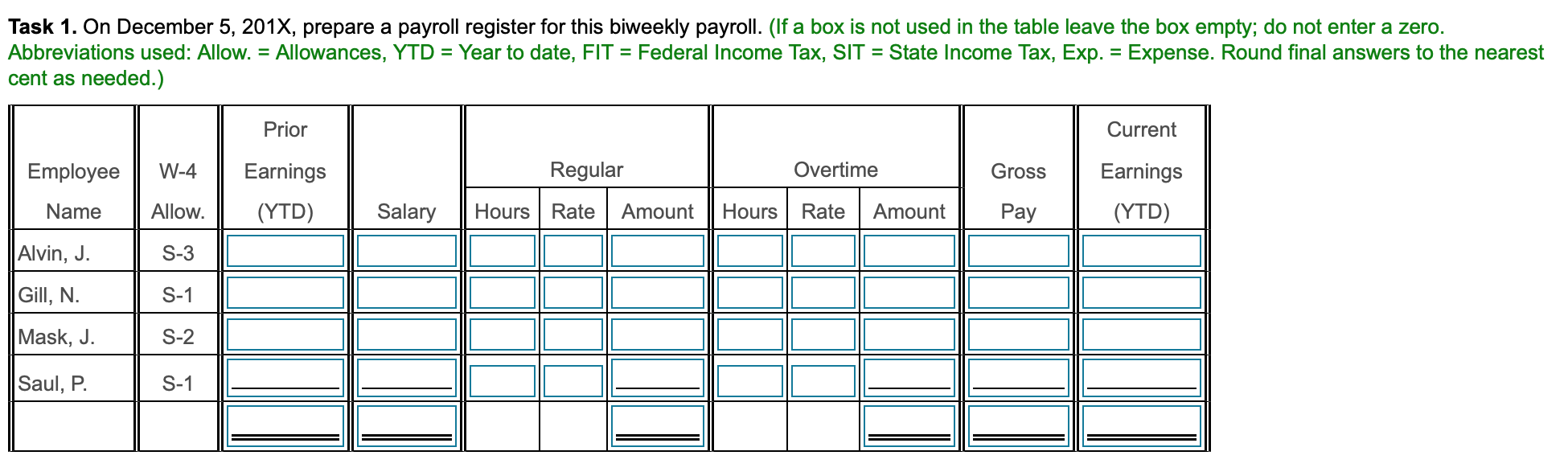

Calculate overtime biweekly payroll

Overtime is calculated on a daily or weekly basis or both. Hence if this process is automated it would be of great benefit as it would require less time to calculate the salary of.

Exercise 7a 1 Calculate Overtime Pay Gross Pay Biweekly Earnings Youtube

According to the US.

. Keep hourly works on a biweekly payroll schedule and salaried employees on a semimonthly schedule. It typically involves keeping track of hours worked and ensuring that employees receive the appropriate amount of pay. Less time to process than weekly payroll.

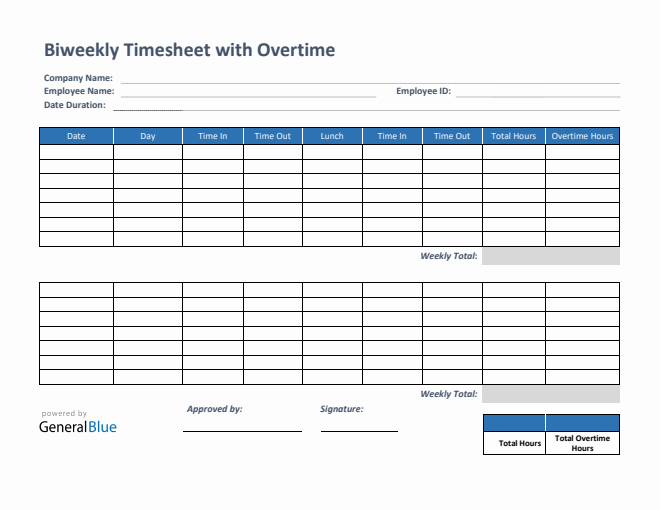

If you have employees who receive paper checks youll print paper checks and. The free timesheet calculators on this page all involve entering the time in and time out to calculate total hours worked. These records must be kept for at least three years and.

Whichever way you decide to structure it make sure you are prepared to do it consistently and accurately. In this employee timesheet template you can view a simple summary of both regular and overtime hours in the Summary Timesheet tab. Paychecks are mailed directly to the employees home on a semi-monthly schedule.

Enter your current payroll information and deductions then enter the hours you expect to work and how much you are paid. Withhold from wages and calculate net pay. Payroll management system encompasses all the tasks involved in paying an organizations employees.

Must pay for non-exempt employees. If the employee isnt exempt from the Fair Labor Standards Act FLSA overtime must be paid for any hours worked over 40 during a standard seven-day work week. Harder to calculate overtime for hourly employees.

A business can have employees being paid on the following basis. Provide overtime pay for each hour an. The list in our collection of Spreadsheet Templates keeps growing and includes large selection of Budget Spreadsheets Retirement Savings and Business Templates with most powerful and easy to use Stock Taking Invoicing Payroll and.

Under the Fair Labor Standards Act you are required to pay overtime wages to nonexempt employees who work more than 40 hours in one workweek. Must pay employees on time. The file includes both weekly and biweekly worksheets in both decimal or hmm time formats.

A week two weeks or a month. Others must be paid at least twice a month. Daily rates are contractual and are based on the employees salary step and differentials if applicable.

Exempt employees include certain white-collar and administrative employees whereas non-exempt employees must be paid overtime if they work more than 40 hours per week. Learning how to calculate. Your bi-weekly pay is calculated by multiplying your daily or hourly rate times the number of days or hours you are paid.

However if you have to terminate a salaried employee you must make sure to calculate hisher final pay correctly as it may be slightly more complicated than for hourly employees. In 2022 there are 26 pay dates under the biweekly schedule. Since one year has 52 weeks the biweekly pay schedule has 26 pay periods during the calendar year.

If you have nonexempt employees you must follow overtime laws. Contact the company that sold you the software for help with the software. Be sure to review the information in the payroll tabs each month to help you calculate the tax amount due for each employee and the company.

560 regular pay 105 overtime pay 665 regular pay. Next you will need to calculate overtime hours. Calculate and deduct taxes benefits premiums garnishments and other authorized deductions and withholdings.

Multiply hours worked by your hourly rate. Calculate hourly and premium rates that could apply if you are paid overtime If you are paid on an hourly or daily basis the annual salary calculation does not apply to you. Within those limitations an employer may designate any paydays he or she.

Payroll calculations can be particularly complex calculations because an organization may hire workers on different payment criteria. The Per Session Payroll is used to pay all pedagogic employees on an hourly or per session. Overtime pay is time and a half or 15 times the employees regular wages.

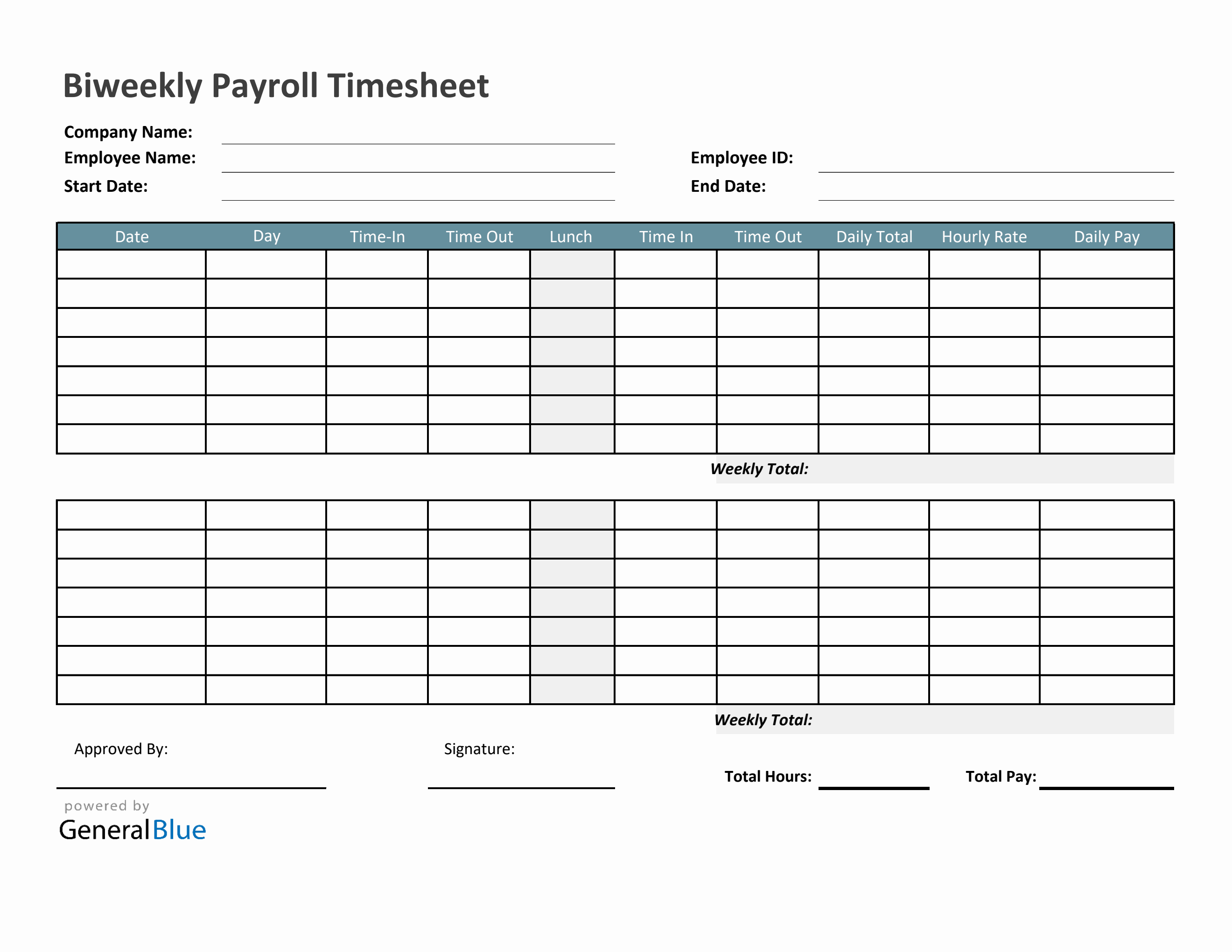

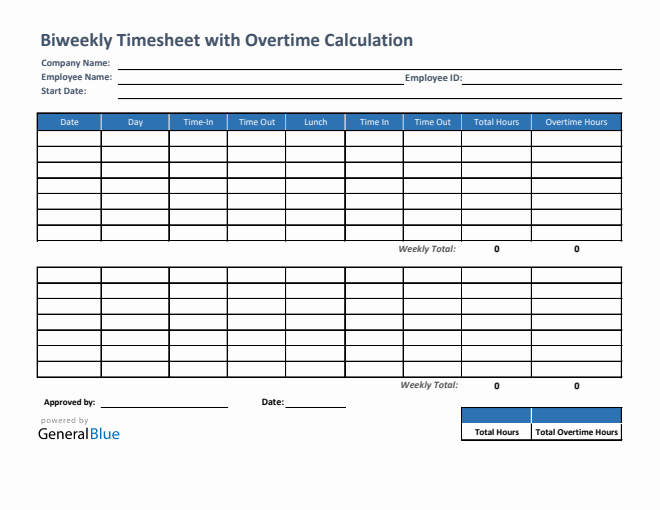

You can also specify the hourly rate for regular hours and overtime hours and the template will automatically generate invoices for payroll and client billing. 2022 Biweekly Payroll Calendar Template. A Microsoft Excel biweekly timesheet calculator also has built-in formulas that can help you calculate every billable working hour automatically.

More Free Time Sheet Templates. Monthly Semi-monthly Bi-weekly Hourly Each payment method has a different way for the calculation of wages thus for a payroll keeper it is important to know how. Using the number of overtime hours you entered in column G and the hourly overtime rate in column D of the monthly payroll tabs.

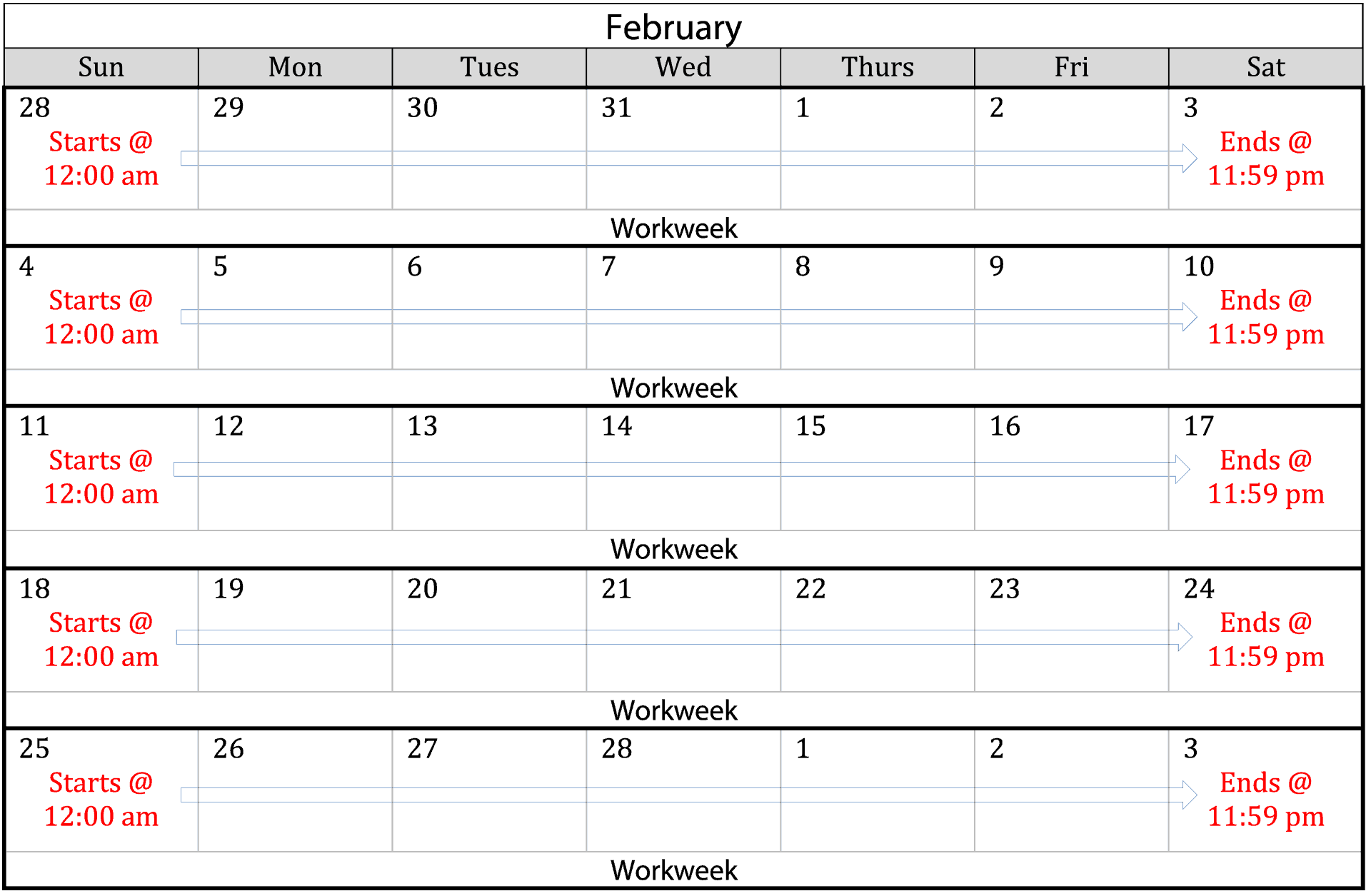

The Per Diem Payroll is a semi-monthly payroll. Biweekly 422 Twenty-six 80-hour pay periods per year consisting of two 40 hour work. Bureau of Labor Statistics 43 of businesses use the biweekly pay schedule making it the most common payroll schedule.

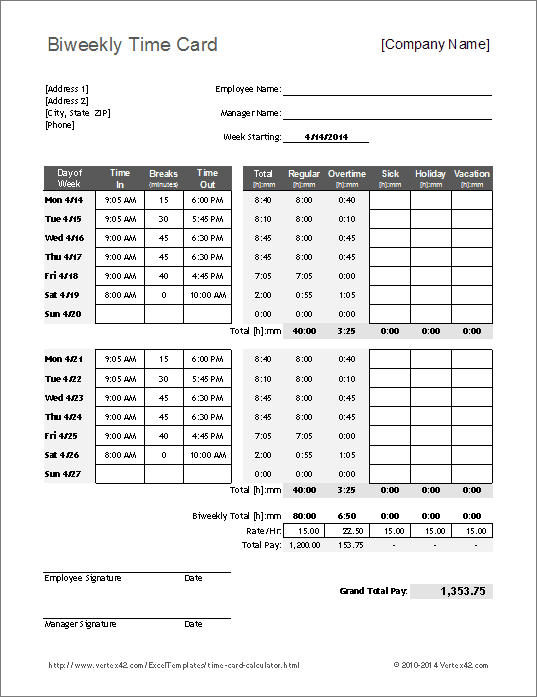

Or in the case of employees who are paid on a weekly biweekly. However each state has a minimum pay frequency law to determine what is the longest period you can have between paydays. The Vertex42 timesheets and timecards contain multiple versions within a single workbook allowing you to choose weekly or bi-weekly or different methods for entering times decimal vs.

You can enter regular overtime and an additional hourly rate if you work a second job. Weekly 338 Fifty-two 40-hour pay periods per year and include one 40 hour work week for overtime calculations. For instance if you worked 70 regular hours during the semi-monthly pay period and earned 10 per hour you would calculate as follows.

Download timesheets and other payroll-related templates for Excel OpenOffice and Google Sheets. Payroll records for example typically include hours worked each day total hours worked during the workweek the basis on which employee wages were paid regular hourly pay rate total overtime for the workweek date of payment and the period covered and total wages paid each period. Time Sheet Template with Breaks.

You may choose to run payroll weekly biweekly or monthly. Each employee who is exempt from the overtime provisions of the federal Fair Labor Standards Act FLSA must be paid at least once a month. A payroll is the list of employees of some company that is entitled to receive payments as well as other work benefits and the.

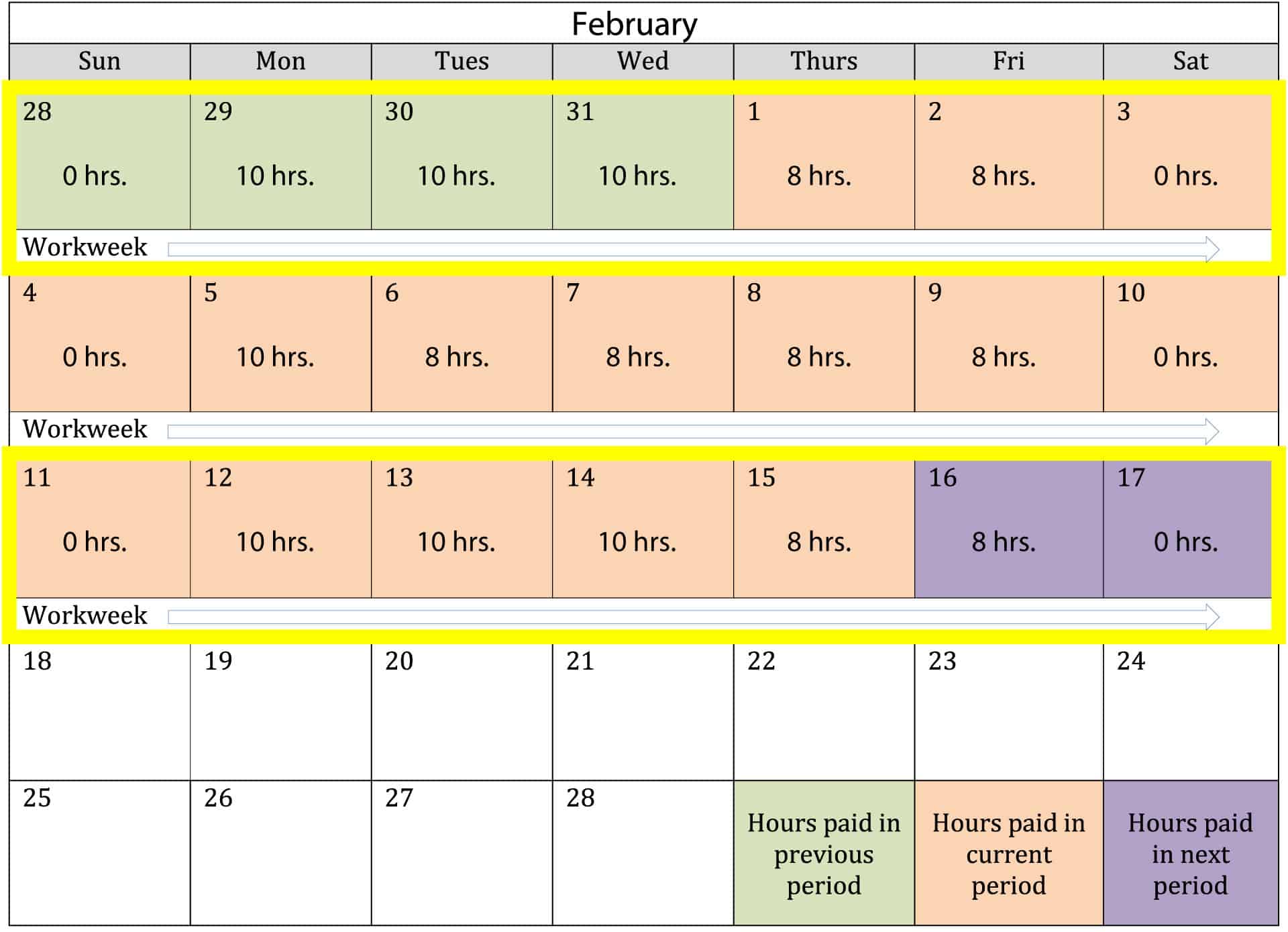

Of course you also need to calculate payroll for salaried employees. Labor Code Section 204 Only the payment of overtime wages may be delayed to the payday of the next following payroll period as the straight time wages must still be paid within the time set forth in the applicable Labor Code section in the pay period in which they were earned. Idaho income tax applies to bonuses commissions overtime pay payments for accumulated sick leave severance pay awards prizes back pay retroactive pay and other similar payments the employee earned while working in Idaho.

70 hours x 10 700 your gross semi-monthly pay. Take shift differentials overtime and other pay practices into consideration. Calculating payroll for salaried employees.

Submit or process payroll. This is done by taking. Semi-monthly pay periods must contain as nearly as possible an equal number of days.

If biweekly input 26 52 weekstwo weeks per pay period 26. This calculator uses the 2019 withholding schedules rules and rates IRS Publication 15.

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

![]()

Download Free Bi Weekly Timesheet Template Replicon

Logwork Free Timesheet Calculator

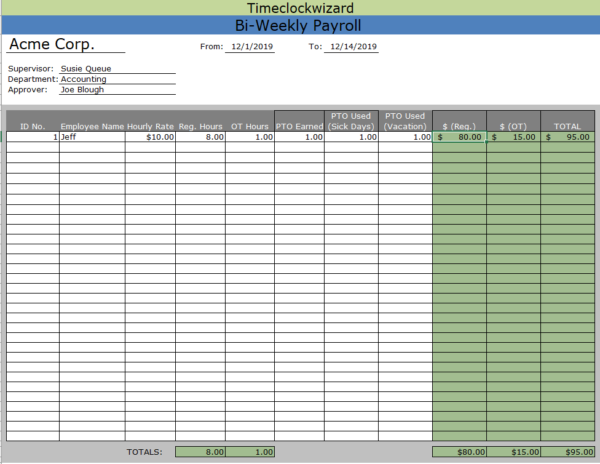

Biweekly Payroll Timesheet In Excel

Free Time Card Calculator Timesheet Calculator For Excel

Ready To Use Overtime Calculator Template With Payslip Msofficegeek

2

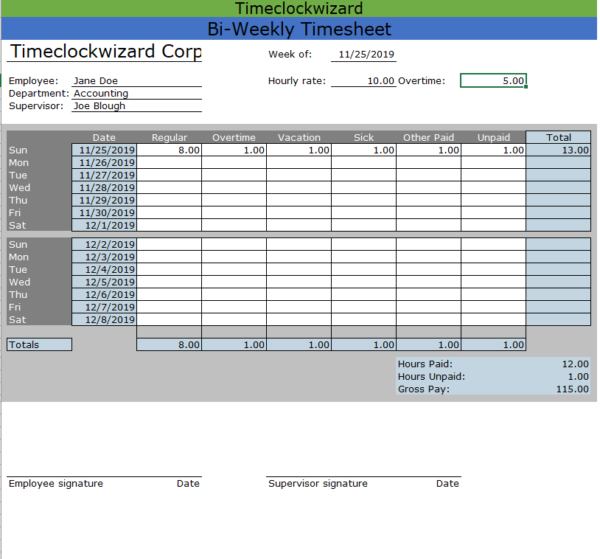

Bi Weekly Timesheet Templates Time Clock Wizard

1 On December 5 201x Prepare A Payroll Register Chegg Com

Overtime Calculator To Calculate Time And A Half Rate And More

Biweekly Timesheet Templates

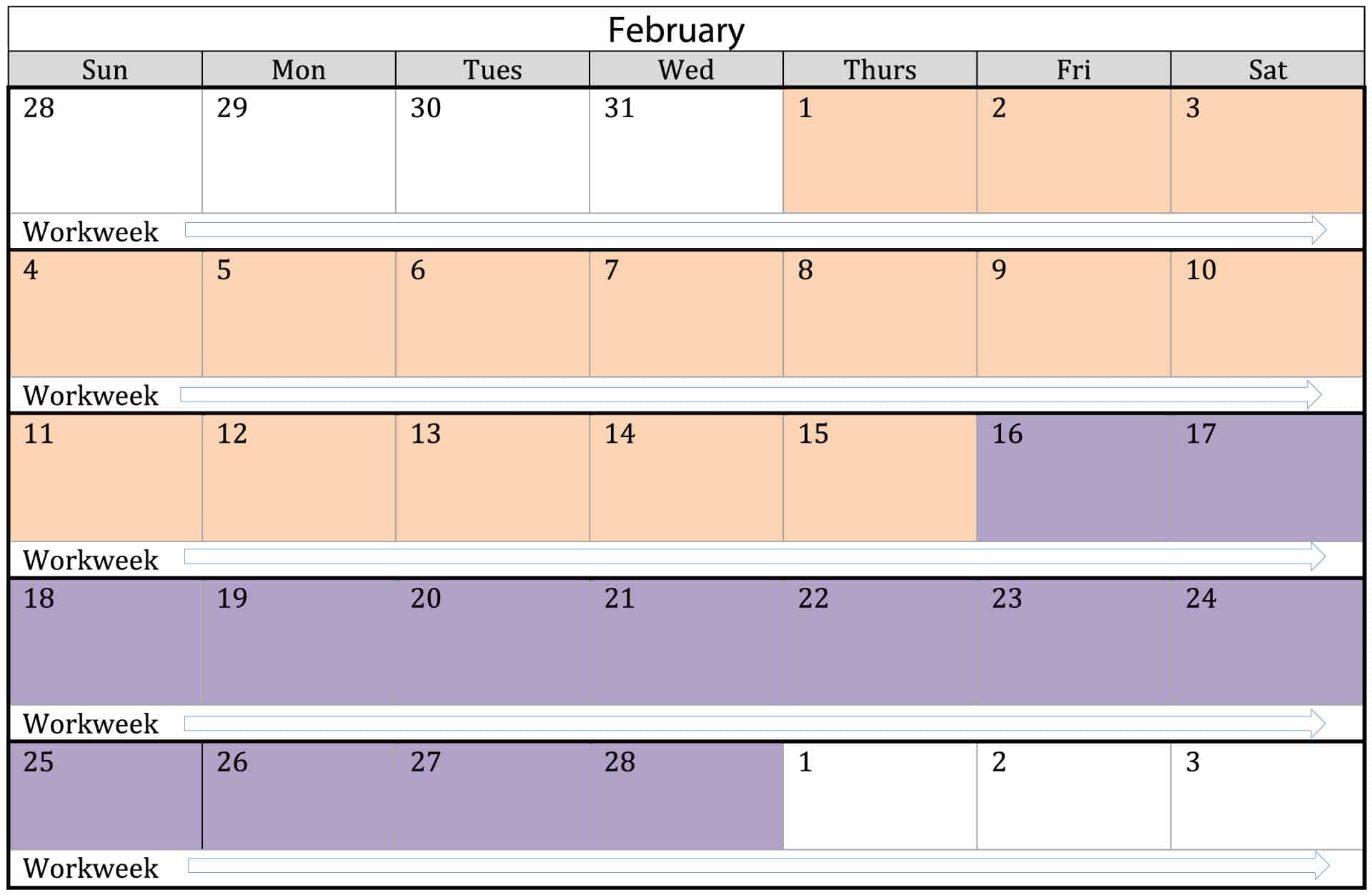

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Bi Weekly Timesheet Templates Time Clock Wizard

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Biweekly Timesheet Templates